Bitmine Immersion Technologies, Inc. $BMNR Investment Thesis

Market Cap: $7.29B

Executive Summary

Investment Rating: SPECULATIVE BUY

Price Target: $55-75 (12-month horizon)

Current Price: $41.84 (as of September 5, 2025)

Market Cap: ~$7.3 billion

Bitmine Immersion Technologies represents the world's most aggressive Ethereum treasury play, combining traditional cryptocurrency mining infrastructure with an unprecedented digital asset accumulation strategy. The company currently holds crypto assets exceeding $8.82 billion, comprised of 1,713,899 ETH at $4,808 per ETH, making it the largest institutional Ethereum holder globally.

1. Investment Summary

Key Investment Thesis Points

Bull Case Catalysts:

World's largest Ethereum treasury with 1.71M+ ETH tokens (~$8.24B)

$1 billion stock repurchase program approved by Board of Directors

Stock trading at $41.84 with $7.3B market cap, representing significant discount to net crypto asset value

Premier institutional backing from ARK Invest, Founders Fund, and other tier-1 investors

Trading as the 20th most liquid US stock with $2.8 billion daily average volume

Risk Factors:

Extreme volatility tied to Ethereum price movements

Recent quarterly net loss of -$622.76K USD

Regulatory uncertainty in cryptocurrency space

High concentration risk in single digital asset

Valuation Framework

With crypto + cash holdings exceeding $8.82 billion and a current market cap of approximately $7.3 billion, BMNR trades at roughly 0.83x its net crypto asset value, representing a 17% discount to underlying holdings—a compelling entry point for Ethereum bulls.

2. Company Overview

Business Model Evolution

Bitmine Immersion Technologies has undergone a dramatic strategic transformation from a traditional cryptocurrency mining operation to the world's largest Ethereum treasury company. The company operates across four primary business segments:

Ethereum Treasury Operations: Aggressive accumulation strategy targeting 5% of total ETH supply

Third-Party Mining Hosting: Infrastructure services for external cryptocurrency miners

Self-Mining Operations: Bitcoin and digital asset mining for company accounts

Data Center Services: Power, cooling, security, and software solutions

Corporate Structure and Leadership

Incorporated: 2019 (formerly Sandy Springs Holdings Inc.)

Headquarters: Las Vegas, Nevada

Exchange: NYSE American (BMNR)

Leadership: Chaired by Tom Lee (Fundstrat Global Advisors founder)

Key Shareholders: ARK Invest, Founders Fund, MOZAYYX, Pantera Capital

Operational Infrastructure

The company leverages proprietary immersion cooling technology for enhanced operational efficiency and reduced energy consumption. Bitmine's custom cooling tech and hefty crypto stash have fueled explosive growth, positioning the company at the intersection of sustainable mining practices and strategic asset accumulation.

3. Market Position and Competitive Analysis

Industry Leadership Metrics

BMNR reigns as the #1 ETH Treasury in the world and 2nd largest crypto treasury globally, establishing clear market leadership in institutional cryptocurrency holdings. This positioning provides several competitive advantages:

Scale Economics: Largest ETH position enables preferential trading terms and market influence

Liquidity Premium: $2.8 billion daily trading volume makes it the 20th most liquid US stock

Institutional Credibility: Premier backing differentiates from smaller mining operations

Competitive Landscape Analysis

Traditional Bitcoin Miners:

Marathon Digital (MARA): Up 152% year-to-date but down 20.4% over the last year

Riot Platforms (RIOT): Up 179% year-to-date, up 33% on 12-month basis

Valuation Concerns: Mining companies like Marathon and Riot show elevated EV/S ratios of 5.6 and 5.5 respectively

BMNR's Differentiation: Unlike traditional Bitcoin-focused miners, BMNR's Ethereum-centric strategy provides:

Asset Appreciation Exposure: Direct leverage to ETH price movements rather than mining difficulty adjustments

Reduced Operational Risk: Less dependent on mining profitability cycles

Treasury Model: Asset accumulation rather than immediate monetization strategy

BMNR's adoption of immersion cooling and green energy partnerships aligns with ESG trends, enhancing its appeal to institutional investors compared to traditional mining operations.

Strategic Moats

First-Mover Advantage: Largest institutional ETH position creates market influence

Institutional Network: Premium investor base provides strategic optionality

Technology Infrastructure: Proprietary cooling systems and data center capabilities

Capital Access: Proven ability to raise capital for continued accumulation

4. Financial Analysis

Revenue and Profitability Trends

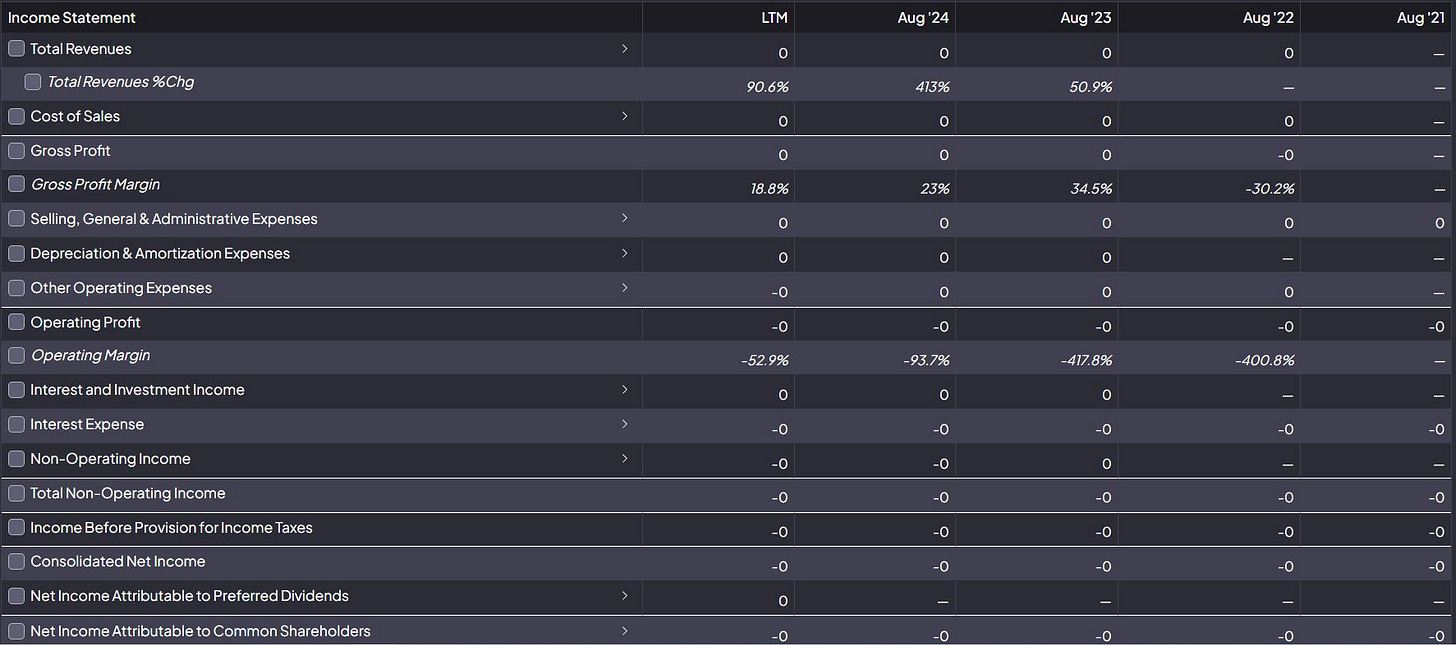

Based on the financial statements provided and recent disclosures:

Revenue Performance:

2024 revenue of $3.31 million, an increase of 413.01% compared to previous year's $645,278

LTM revenue growth of 90.6% with high volatility

Gross profit margin improved to 18.8% LTM from negative territory in 2022

Operating margin remains negative at -52.9% LTM, though improving from -400.8% in 2022

Cash Flow Analysis: The financial statements show minimal operational cash flow generation, with most value creation coming from crypto asset appreciation rather than operational activities. This reflects the company's strategic pivot toward treasury operations.

Balance Sheet Strength:

Crypto Holdings: $8.82 billion in crypto + cash holdings as of August 24th, 2025

ETH Position: 1,713,899 ETH tokens at $4,808 per ETH

Growth Trajectory: ETH holdings have grown from 833,137 tokens worth $2.9 billion on August 3rd to over 1.7 million tokens by late August

Loss Analysis: Losses were -$3.29 million in 2024, 33.6% more than in 2023, indicating continued operational challenges despite revenue growth. However, these operational losses are dwarfed by potential crypto asset appreciation.

Valuation Metrics and NAV Analysis

Net Asset Value Calculation:

Current crypto holdings: ~$8.24 billion (1,713,899 ETH × $4,808)

Additional cash and assets: ~$580 million

Total NAV: ~$8.82 billion

Current Market Cap: ~$7.3 billion

P/NAV Ratio: 0.83x (17% discount)

Valuation Comparative: Unlike traditional mining stocks valued on cash flow multiples, BMNR should be valued primarily on net asset value given its treasury-focused strategy. The current 17% discount to NAV represents compelling value for investors bullish on Ethereum.

Capital Allocation Strategy

The Board of Directors has approved a $1 billion stock repurchase program, demonstrating management's confidence in the stock's undervaluation and commitment to shareholder returns. This represents approximately 13.7% of current market cap.

5. Growth Opportunities and Catalysts

Ethereum Accumulation Strategy

The company's stated goal of acquiring 5% of total ETH supply (approximately 6 million tokens) represents massive upside potential. Current holdings of 1.71 million ETH suggest significant future accumulation opportunities.

Market Catalysts

Ethereum Price Appreciation: Each $100 increase in ETH price adds ~$171 million to company value

Institutional Adoption: Growing corporate treasury adoption of cryptocurrency

ETF Inflows: Ethereum ETF approval could drive institutional demand

Staking Rewards: Potential yield generation from ETH 2.0 staking

Share Buybacks: $1 billion repurchase program reducing share count

Operational Expansion

Mining Infrastructure: Expansion of hosting services for third-party operators

Technology Licensing: Proprietary cooling technology commercialization

Geographic Expansion: International mining facility development

Strategic Partnerships: Potential collaborations with other crypto companies

ESG and Sustainability

BMNR's adoption of immersion cooling and green energy partnerships aligns with ESG trends, potentially attracting ESG-focused institutional capital and improving long-term sustainability metrics.

6. Risk Assessment

Primary Risk Factors

Cryptocurrency Volatility (High Risk):

80%+ correlation with Ethereum price movements

Potential for 50%+ daily price swings during market stress

Regulatory changes affecting cryptocurrency values

Concentration Risk (High Risk):

Over 90% of value tied to single cryptocurrency (Ethereum)

Limited diversification across digital assets

Single point of failure in investment thesis

Operational Risk (Medium Risk):

Continued quarterly losses of -$622.76K USD

Dependence on external financing for operations

High risk and slim profits mean it's not for the faint of heart

Regulatory Risk (Medium-High Risk):

Evolving cryptocurrency regulations

Potential taxation changes affecting digital assets

Securities law implications for treasury operations

Liquidity Risk (Low-Medium Risk):

Large ETH position may face liquidity constraints during market stress

Potential need to liquidate assets at unfavorable prices

Market impact of large-scale ETH sales

Risk Mitigation Strategies

Diversification: Consider position sizing within broader portfolio

Volatility Management: Use options strategies for downside protection

Monitoring: Close attention to regulatory developments and Ethereum ecosystem changes

7. Institutional and Retail Interest Analysis

Institutional Backing

The company benefits from premier institutional support:

ARK Invest (Cathie Wood):

Significant holder across multiple ARK funds

Strategic validation of Ethereum treasury thesis

Continued accumulation signals conviction

Other Notable Investors:

Founders Fund: Peter Thiel's investment vehicle

MOZAYYX: Strategic technology investor

Pantera Capital: Leading crypto-focused fund

Tom Lee: Chairman and Fundstrat founder provides strategic oversight

Retail Interest Dynamics

The stock has experienced significant retail-driven momentum:

High daily trading volumes indicating active retail participation

Social media attention driving periodic price spikes

Meme stock characteristics due to crypto exposure and prominent backers

Market Sentiment Indicators

Trading as the 20th most liquid US stock indicates strong investor interest and accessibility, while the premium institutional backing provides credibility for retail investors seeking crypto exposure through traditional equity markets.

8. Technical and Quantitative Analysis

Trading Characteristics

Daily Volume: $2.8 billion average daily trading volume

Volatility: High correlation with cryptocurrency markets (estimated 90%+ correlation with ETH)

Liquidity: Exceptional liquidity for crypto-exposed equity

Quantitative Metrics

Beta to ETH: Estimated 1.2-1.5x (leveraged exposure to Ethereum movements)

Sharpe Ratio: Negative due to operational losses, but improving with asset appreciation

Maximum Drawdown: Subject to crypto market cycles (50%+ potential drawdowns)

Options Market Analysis

High options activity reflects:

Significant institutional hedging activity

Retail speculation on cryptocurrency movements

Volatility premium due to crypto correlation

9. Macroeconomic Considerations

Cryptocurrency Market Dynamics

Institutional Adoption: Growing corporate treasury allocation to digital assets

Regulatory Clarity: Potential positive regulatory developments for cryptocurrency sector

Federal Reserve Policy: Interest rate environment affecting risk asset allocation

Inflation Hedge: Potential cryptocurrency role as digital store of value

Ethereum-Specific Factors

Network Upgrades: Continued Ethereum protocol improvements

DeFi Growth: Decentralized finance ecosystem expansion

NFT Markets: Non-fungible token market development

Enterprise Adoption: Corporate use case expansion

10. Investment Outlook and Price Targets

Base Case Scenario (60% probability)

Price Target: $55-65

Ethereum trades in $4,500-$5,500 range

Continued modest ETH accumulation

Operational improvements reduce losses

NAV discount narrows to 5-10%

Bull Case Scenario (25% probability)

Price Target: $75-95

Ethereum reaches $6,000-$7,000

Successful completion of share buyback program

Significant additional ETH accumulation

Premium valuation to NAV due to scarcity value

Bear Case Scenario (15% probability)

Price Target: $20-30

Ethereum declines below $3,000

Regulatory challenges affect operations

Forced asset liquidation due to operational needs

Market assigns liquidity discount to holdings

Catalysts Timeline

Near-term (3-6 months):

Q3/Q4 2025 earnings reports

Progress on $1 billion share buyback program

ETH accumulation updates

Medium-term (6-18 months):

Ethereum network upgrades and adoption metrics

Potential dividend or distribution policy

Strategic partnership announcements

Long-term (18+ months):

Achievement of 5% ETH supply target

Operational profitability milestone

Potential strategic alternatives evaluation

11. Portfolio Construction and Risk Management

Position Sizing Recommendations

Conservative Investors (1-2% allocation):

Risk-averse portfolios seeking limited crypto exposure

Focus on institutional credibility and discount to NAV

Growth Investors (3-5% allocation):

Higher risk tolerance for potential outsized returns

Belief in long-term Ethereum adoption thesis

Aggressive/Crypto-Focused (5-10% allocation):

High conviction in cryptocurrency sector

Seeking leveraged Ethereum exposure through equity markets

Risk Management Strategies

Portfolio Hedging:

Use put options for downside protection

Pair trade against traditional mining stocks

Currency hedging for international investors

Position Management:

Scale in during market weakness

Take profits on significant crypto rallies

Rebalance based on NAV discount/premium

Monitoring Framework:

Daily ETH price and holdings updates

Quarterly operational metrics

Regulatory development tracking

Competitive landscape changes

12. ESG and Sustainability Considerations

Environmental Impact

BMNR's adoption of immersion cooling and green energy partnerships aligns with ESG trends, addressing key environmental concerns about cryptocurrency mining:

Energy Efficiency: Immersion cooling reduces power consumption

Renewable Energy: Strategic partnerships with clean energy providers

Carbon Footprint: Lower emissions per hash rate compared to traditional mining

Governance Factors

Board Composition: Experienced leadership with Tom Lee as Chairman

Institutional Oversight: Premium investor base provides governance discipline

Transparency: Regular disclosure of cryptocurrency holdings and strategy

Social Impact

Financial Innovation: Pioneering institutional cryptocurrency adoption

Technology Development: Advancing sustainable mining practices

Economic Development: Job creation in Nevada and other operational locations

13. Conclusion and Investment Recommendation

Investment Thesis Summary

Bitmine Immersion Technologies represents a unique investment opportunity at the intersection of traditional equity markets and cryptocurrency innovation. The company's position as the world's largest Ethereum treasury, combined with premier institutional backing and significant trading at a discount to net asset value, creates a compelling risk-adjusted return profile for investors seeking leveraged Ethereum exposure.

Key Strengths:

Unparalleled Ethereum Exposure: 1,713,899 ETH tokens worth $8.24 billion

Institutional Credibility: Backing from ARK, Founders Fund, and other tier-1 investors

Valuation Discount: Trading 17% below net crypto asset value

Capital Allocation: $1 billion share repurchase program

Liquidity: $2.8 billion daily trading volume

Primary Risks:

Crypto Volatility: High correlation with Ethereum price movements

Concentration: Over-reliance on single digital asset

Operational Losses: Continued quarterly losses

Regulatory Uncertainty: Evolving cryptocurrency regulatory environment

Final Recommendation: SPECULATIVE BUY

Rating Rationale: BMNR offers institutional-quality access to Ethereum appreciation with additional optionality from operational improvements and strategic initiatives. The 17% discount to NAV provides downside protection while maintaining full upside participation in cryptocurrency market expansion.

Ideal Investor Profile:

High risk tolerance for cryptocurrency-related volatility

Strong conviction in Ethereum's long-term adoption and value appreciation

Portfolio allocation seeking alternative asset exposure through traditional equity markets

Time horizon of 12-36 months to allow thesis to develop

Position Sizing Guidance: Recommend 2-5% portfolio allocation depending on risk tolerance and cryptocurrency conviction, with strict risk management protocols including stop-losses and periodic rebalancing based on NAV discount/premium dynamics.

The combination of institutional backing, significant asset discount, and leveraged exposure to the world's second-largest cryptocurrency creates a compelling investment opportunity for investors willing to accept the inherent volatility and execution risks associated with this pioneering treasury strategy.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Cryptocurrency-related investments carry significant risks including total loss of capital. Past performance does not guarantee future results. Investors should conduct their own due diligence and consult with qualified financial advisors before making investment decisions.