Executive Summary

Oklo, a company specializing in advanced nuclear energy solutions, presents a high-risk, high-reward investment opportunity. The firm is focused on the commercialization of small modular reactors (SMRs) that leverage atomic fission to generate sustainable energy. While Oklo’s innovative technology and market positioning provide significant growth potential, the company is currently operating at a loss, with increasing operating expenses and negative cash flow. However, strong investment inflows and strategic partnerships may drive long-term profitability.

Financial Analysis

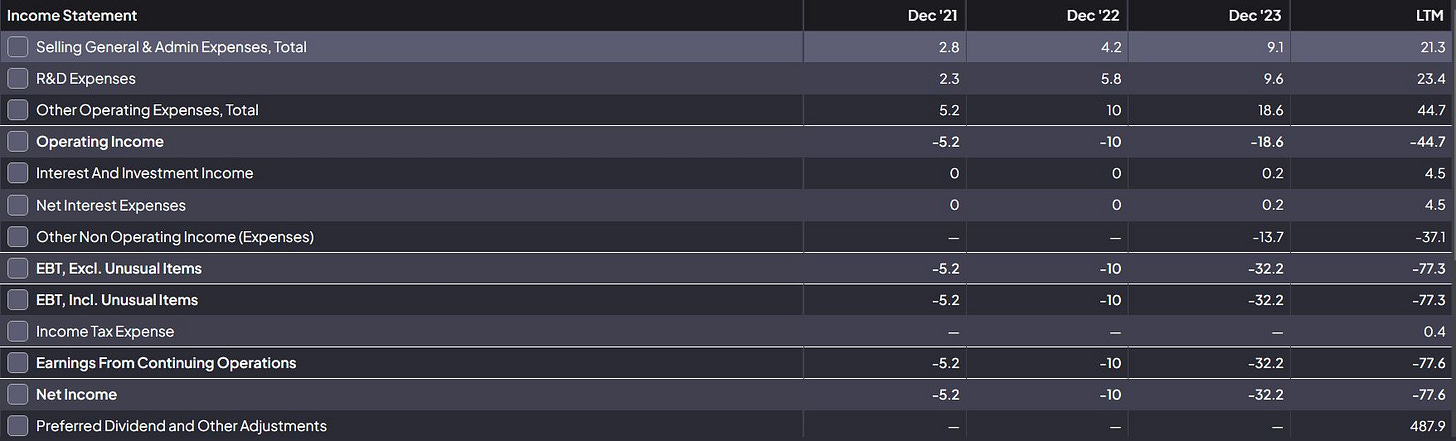

Oklo’s financial performance over the past three years highlights its status as a high-growth but cash-intensive enterprise. Key financial metrics include:

Revenue: Currently negligible, reflecting the early-stage nature of the business.

Operating Expenses:

SG&A expenses increased from $28M in 2021 to $91M in 2023, indicating rising costs related to business expansion.

R&D expenses surged from $23M to $96M over the same period, highlighting strong investment in technology development.

Net Income:

The company remains unprofitable, with net losses growing from $5.2M in 2021 to $77.6M in 2023.

Significantly preferred dividend payments ($487.9M in 2023) further impact the bottom line.

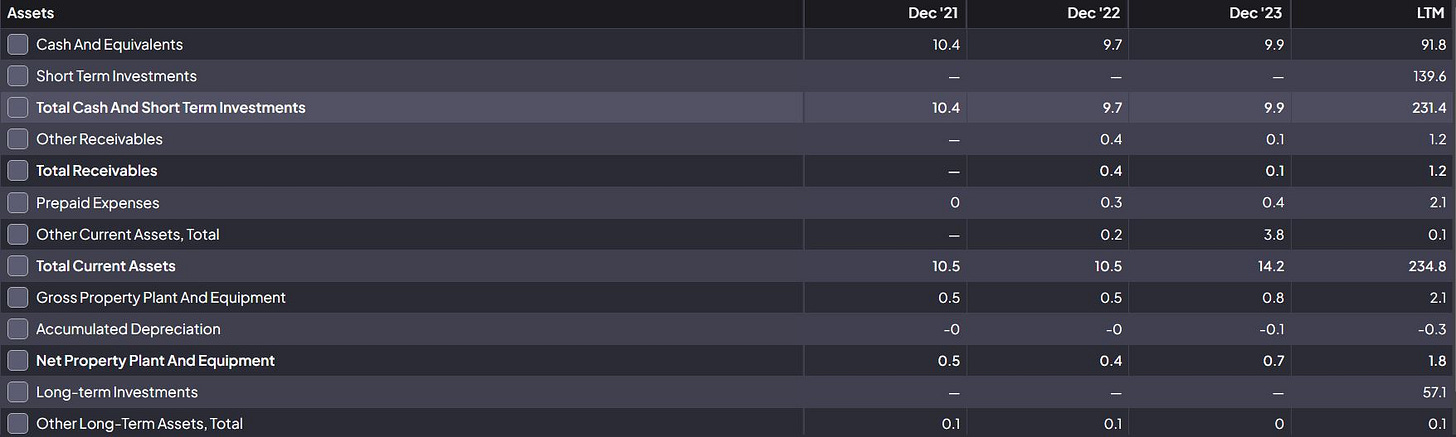

Balance Sheet Strength:

Cash and short-term investments increased to $139.6M in 2023, supported by investor funding.

Long-term investments reached $571M, reflecting capital deployment into future revenue-generating assets.

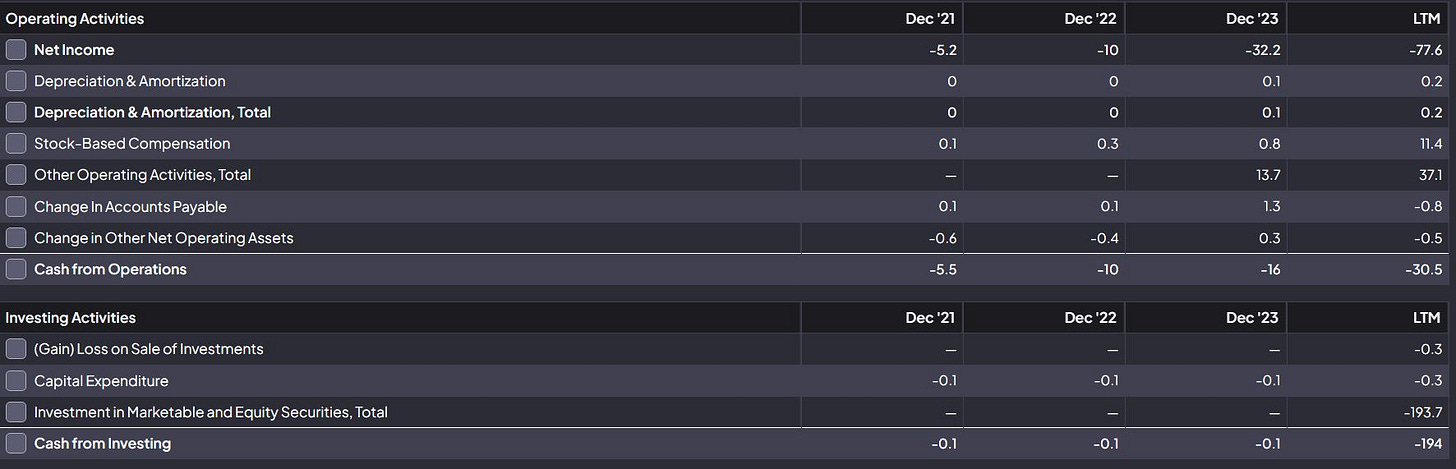

Cash Flow:

Operating cash flow deteriorated from -$5.5M in 2021 to -$30.5M in 2023.

Significant capital expenditures remain low at ~$0.3M, but investment in marketable securities amounted to $193.7M in 2023.

Opportunities

Growth in Nuclear Energy Demand: With increasing global energy needs and a push for clean energy, nuclear power is regaining attention, particularly SMRs, which offer scalable and cost-effective solutions.

Government and Regulatory Support: Oklo could benefit from favorable policies and funding initiatives aimed at reducing carbon emissions and promoting advanced nuclear technologies.

First-Mover Advantage: Oklo is one of the few players developing SMRs for commercial use, positioning itself as a leader in a nascent but potentially lucrative market.

Strategic Partnerships and Funding: The company has successfully attracted investment and may continue leveraging partnerships with government agencies and private investors to fund its R&D and commercialization efforts.

Risks

Regulatory Hurdles: Nuclear energy remains heavily regulated, and Oklo’s technology must undergo rigorous testing and approval before commercialization.

High Cash Burn Rate: The company’s negative cash flow and growing losses pose a financial sustainability risk unless it secures additional funding.

Technology and Execution Risks: While promising, SMRs remain largely unproven at scale, and any technical failures or delays could impact commercialization.

Competition: Larger energy firms with greater resources may enter the SMR space, posing a threat to Oklo’s market share.

Valuation

As Oklo has not yet generated meaningful revenue, traditional valuation metrics such as P/E and EBITDA multiples are not applicable. However, considering its substantial investment in R&D and cash position, the valuation approach must focus on:

Comparable Company Analysis: Examining valuations of similar early-stage nuclear firms and renewable energy startups.

Discounted Cash Flow (DCF) Model: Projecting future revenue based on expected SMR adoption and applying a high discount rate to account for execution risks.

Market Capitalization vs. Cash Reserves: Assessing whether the company’s cash position and investments justify its current valuation.

Conclusion

Oklo represents a speculative but potentially lucrative investment in the emerging SMR sector. Its financials indicate a high cash burn rate, but strong capital inflows and market positioning provide a foundation for long-term success. The company’s ability to manage costs, secure regulatory approvals, and achieve commercialization milestones will be key to determining its future trajectory.

Recommendation

Hold/Speculative Buy – Investors with a high-risk tolerance may consider a position in Oklo, given its disruptive potential. However, continued monitoring of cash flow, funding rounds, and regulatory progress is essential before increasing exposure.

Really interesting breakdown of Oklo’s potential. It’s crazy to think about how much demand for clean energy is growing, but also how risky and challenging the path forward is for companies like Oklo. With all the hurdles ahead, do you think they’ll manage to push through, or will bigger players take over the SMR space?

Could you please reply to my dm?