1. Investment Summary

Oscar Health, Inc. (NYSE: OSCR) is a technology-driven health insurance company focused on providing affordable, consumer-centric healthcare coverage. Leveraging its proprietary +Oscar platform, the company aims to disrupt the traditional insurance model by enhancing user engagement, optimizing claims processing, and improving risk management.

Despite strong revenue growth (CAGR of 101% from 2020-2023) and market expansion, profitability remains a challenge. The company has improved its loss ratios but still faces high operating expenses and policy benefit payouts.

Investment Thesis

Oscar presents a high-risk, high-reward opportunity in the insure-tech space. Its differentiated technology platform and growing market presence provide significant upside, but continued losses and cash burn create concerns. The investment case hinges on scalability, cost optimization, and execution of its long-term profitability strategy.

Key Investment Considerations

✅ Rapid revenue growth (~101% CAGR over three years).

✅ Tech-driven business model with long-term scaling potential.

⚠️ Negative cash flow & profitability challenges.

⚠️ Regulatory & competitive risks in a highly concentrated industry.

2. Company Overview

Oscar Health, Inc. provides individual, small group, and Medicare Advantage health plans across multiple U.S. states. The company differentiates itself through data-driven underwriting, AI-powered engagement tools, and a member-friendly mobile app.

Founded in 2012, Oscar aims to reshape the health insurance landscape by focusing on affordability, accessibility, and digital-first experiences.

Key Financials (2023)

Revenue: $5.86 billion

Net Loss: $(189.3) million

Total Members: ~1.2 million

Cash & Investments: $2.92 billion

3. Competitive Positioning

Oscar operates in a highly competitive insurance industry dominated by major players such as UnitedHealth (UNH), Anthem (ELV), Humana (HUM), and CVS-Aetna (CVS).

Competitive Advantages

Tech-Driven Differentiation: The +Oscar platform enhances claims processing, risk management, and customer engagement.

Direct-to-Consumer Model: Unlike incumbents relying on employer-based insurance, Oscar targets individuals and small businesses, benefiting from market shifts.

Data-Driven Underwriting: AI-powered analytics help Oscar optimize pricing and risk selection, potentially improving long-term profitability.

Competitive Challenges

Scale Disadvantage: Lacks the pricing power and economies of scale of larger insurers.

Regulatory Risk: Faces compliance and policy risks in the evolving healthcare landscape.

High Customer Acquisition Costs: Spending on growth and retention impacts profitability.

4. Opportunities

1. Expansion in Medicare Advantage

The U.S. Medicare Advantage market is growing rapidly, with an aging population driving increased demand. If Oscar successfully scales its senior-focused offerings, it could unlock a multi-billion-dollar revenue stream.

2. Scaling the +Oscar Platform

Oscar’s B2B partnerships with healthcare providers using its +Oscar platform could diversify revenue streams beyond traditional insurance premiums.

3. Improved Cost Efficiency & Margins

The company’s Medical Loss Ratio (MLR) has improved from 96.5% in 2021 to 84.1% in 2023, suggesting better risk pricing and cost control. If Oscar further reduces expenses, profitability could be within reach.

4. Favorable Market Tailwinds

Rising healthcare costs push consumers toward innovative, cost-effective insurers.

Government subsidies and regulatory support for ACA marketplaces benefit Oscar’s core market.

5. Risks

1. Persistent Losses & Cash Burn

Oscar remains unprofitable, reporting a $(189.3) million operating loss in 2023. If cost controls fail, the company may require additional capital raises, leading to dilution.

2. High Medical Loss Ratio (MLR) Sensitivity

While MLR has improved, unexpected spikes in claims costs (e.g., due to inflation, pandemics, or mispricing) could erode margins.

3. Competitive Pressure

Oscar competes with larger, better-capitalized insurers. If competitors replicate Oscar’s tech innovations, its differentiation could diminish.

4. Regulatory Uncertainty

Changes in ACA policies, pricing regulations, or Medicare reimbursement could significantly impact Oscar’s business model.

6. Financial Analysis

Income Statement Highlights

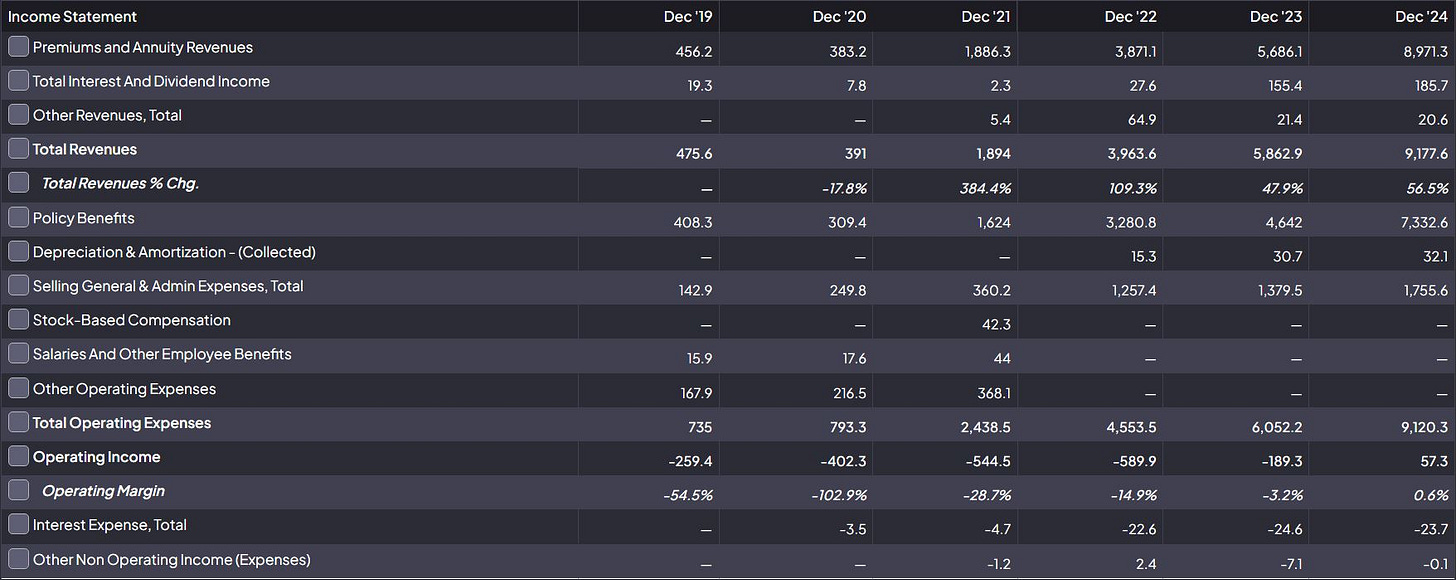

📊 Revenue Growth & Expenses

Revenue surged from $391 million (2020) to $5.86 billion (2023), projected to reach $9.18 billion in 2024.

Operating loss narrowed to $(189.3) million in 2023, showing progress toward profitability.

📷 (See detailed financials from the income statement.)

Balance Sheet Highlights

📊 Financial Stability & Assets

Cash & Equivalents: $1.87 billion (2023).

Total Assets: Expected to grow to $4.84 billion in 2024.

📷 (See detailed financials from the balance sheet.)

Cash Flow Statement Highlights

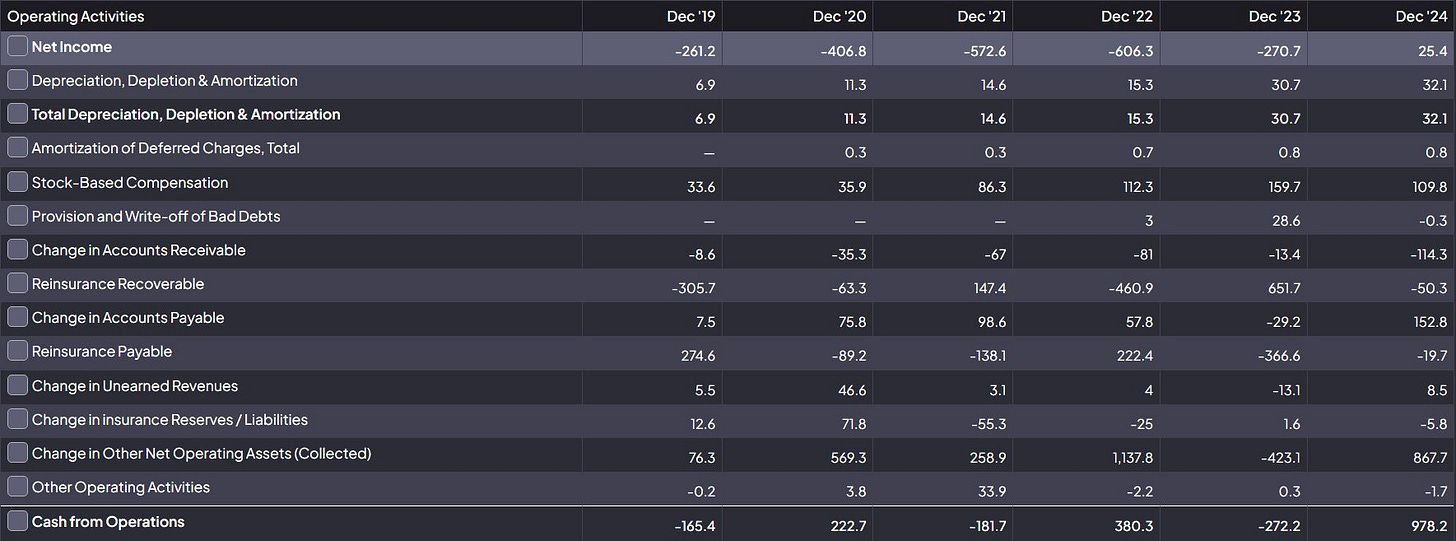

📊 Liquidity & Cash Generation

Operating cash flow was negative in 2023 but is projected to improve significantly in 2024.

Stock-based compensation remains high, indicating potential dilution risks.

📷 (See detailed financials from the cash flow statement.)

7. Investment Outlook

Bull Case 📈

If Oscar successfully:

✅ Expands Medicare Advantage & B2B partnerships.

✅ Lowers its MLR and operating costs.

✅ Achieves positive cash flow by 2025.

🚀 Potential Upside: Oscar Health could emerge as a profitable, scalable insurtech leader, with significant valuation growth.

Bear Case 📉

If Oscar struggles with:

❌ Persistent losses and cash burn.

❌ Regulatory or pricing pressures affecting margins.

❌ Higher-than-expected claims costs.

🔻 Potential Downside: The company could face further dilution, additional capital raises, or a strategic acquisition at a discount.

8. Conclusion & Recommendation

Oscar Health presents a compelling but speculative investment opportunity in the tech-driven insurance sector. The company has strong revenue momentum, a differentiated tech platform, and a potential path to profitability. However, persistent losses, cash burn, and industry competition remain key risks.

Final Verdict: Speculative Buy

🎯 Risk-Tolerant Investors: Attractive for high-risk, high-reward portfolios, betting on Oscar’s long-term profitability story.

⚠️ Conservative Investors: May prefer waiting for clearer profitability signals before investing.

💡 Monitor key catalysts:

Improvement in MLR and operating margins.

Expansion of +Oscar platform partnerships.

Path to cash flow breakeven by 2025-2026.

🚀 If executed successfully, Oscar could become a major disruptor in digital health insurance.