1. Investment Summary

Palantir Technologies has transformed from a government-focused data analytics firm to a high-growth enterprise software company with an expanding commercial presence. Based on the financial data, PLTR has achieved remarkable revenue growth (28.8% YoY in 2024) while transitioning to profitability after years of losses. The company's innovative AI platform, strong government relationships, and expanding commercial footprint position it well in the growing data analytics and artificial intelligence markets. However, investors should consider the concentrated customer base, high stock-based compensation, and competitive pressures. Despite its premium valuation, improving cash flows, strengthening margins, and strategic AI investments, PLTR represents a compelling long-term growth opportunity.

2. Company Overview

Founded in 2003 and headquartered in Denver, Colorado, Palantir Technologies specializes in big data analytics software platforms. The company's primary products include:

Palantir Gotham: Enterprise platform enabling users to identify patterns in diverse datasets, primarily used by government agencies for intelligence, defense, and counterterrorism.

Palantir Foundry: Commercial-focused platform that integrates and analyzes fragmented data sources, creating a central operating system for enterprise data.

Palantir Apollo: A continuous delivery system that enables software deployment and updates across environments.

Palantir Artificial Intelligence Platform (AIP): A newer offering that provides unified access to large language models (LLMs) and transforms structured/unstructured data for AI applications.

Palantir's business model relies on long-term contracts with government entities and increasingly with commercial enterprises, targeting data-rich organizations with complex operational challenges.

3. Competitive Positioning

Strengths:

Deep Technical Expertise: Palantir's software addresses highly complex data integration challenges that few competitors can match.

Government Relationships: Strong, established contracts with intelligence agencies and defense departments create high switching costs and recurring revenue.

AI Integration: Early mover in operationalizing AI for enterprise applications through AIP, positioning the company at the forefront of the AI revolution.

Scalable Platform: Ability to deploy across diverse industries and use cases enables expansion into new markets.

Competitive Landscape:

Palantir faces competition from various fronts:

Large enterprise software providers (Microsoft, Oracle, SAP)

Specialized analytics firms (Alteryx, Databricks, Snowflake)

In-house solutions developed by potential customers

Consulting firms offering custom data solutions

Palantir's differentiation lies in its integration of sophisticated data analytics with AI capabilities and operational workflows in a secure environment, particularly valuable for sensitive government applications and complex commercial operations.

4. Opportunities

Commercial Market Expansion

The financial data shows growing commercial adoption, representing a substantial growth vector. While government contracts formed Palantir's foundation, the commercial sector offers a larger addressable market.

AI-Driven Growth

The Palantir Artificial Intelligence Platform (AIP) represents a significant opportunity as organizations increasingly seek to operationalize AI. By connecting large language models with organizational data and workflows, AIP positions Palantir advantageously in the rapidly growing AI software market.

International Expansion

Geographic diversification beyond the United States presents substantial growth opportunities, particularly in regions prioritizing data sovereignty and security.

Industry Verticalization

Developing industry-specific solutions for healthcare, financial services, and manufacturing can drive higher-value contracts and deeper customer relationships.

5. Risks

Customer Concentration

Historically, Palantir has relied on a relatively small number of large contracts, creating revenue volatility if major customers reduce spending or discontinue relationships.

Stock-Based Compensation

The financial data reveals substantial stock-based compensation (SBC) expenses ($691.6M in 2024), potentially diluting shareholders. Though declining as a percentage of revenue, SBC remains high relative to peers.

Geopolitical and Regulatory Risks

Government contracts may be affected by changing political priorities. Additionally, data privacy regulations could impact Palantir's operations and customer adoption.

Valuation Concerns

Given its high growth premium, any slowdown in growth or margin improvement could trigger significant share price corrections.

Competitive Pressure

As AI becomes more mainstream, competition from both established players and emerging startups could intensify.

6. Financial Analysis

Revenue Growth

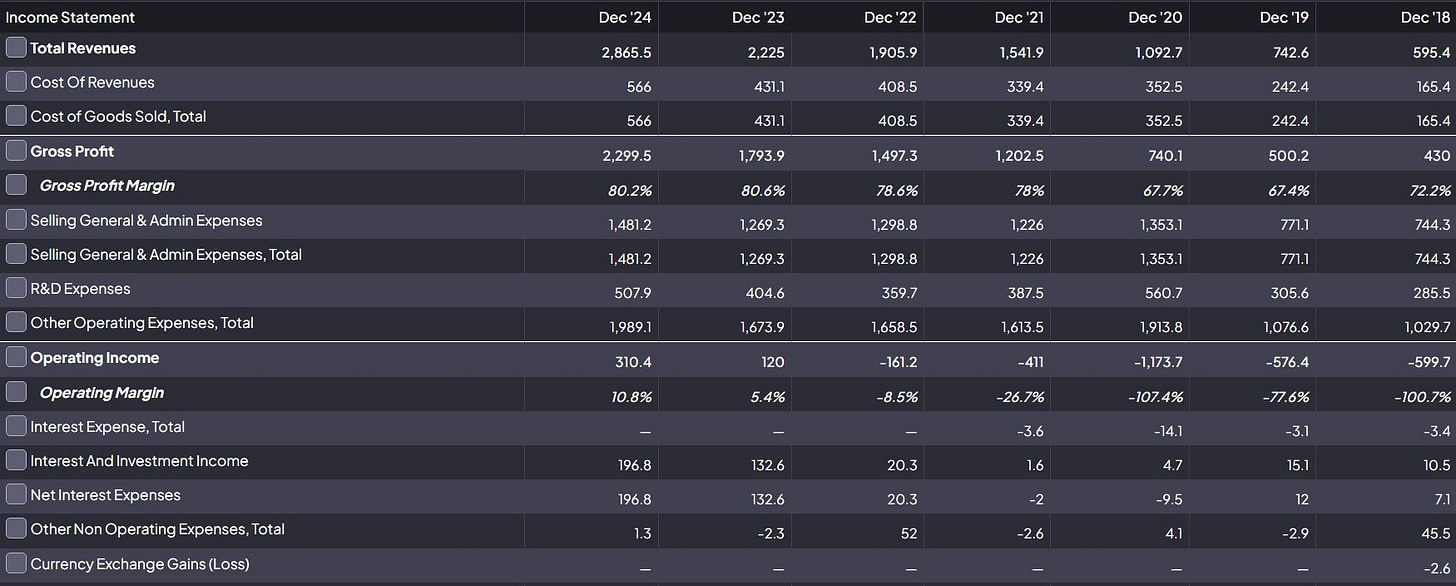

Palantir has demonstrated impressive revenue growth:

2024: $2,865.5M (28.8% YoY growth)

2023: $2,225.0M (16.7% YoY growth)

2022: $1,905.9M (23.6% YoY growth)

2021: $1,541.9M (41.1% YoY growth)

2020: $1,092.7M (47.1% YoY growth)

The consistent revenue acceleration in recent years suggests strengthening market demand for Palantir's offerings.

Profitability Transformation

The most remarkable aspect of Palantir's financial performance is its transition to profitability:

2024: $462.2M net income (16.1% net margin)

2023: $209.8M net income (9.4% net margin)

2022: -$373.7M net loss

2021: -$520.4M net loss

2020: -$1,166.4M net loss

This dramatic improvement demonstrates the scalability of Palantir's business model and efficient operational execution.

Margin Expansion

Gross margin has remained consistently strong:

2024: 80.2%

2023: 80.6%

2022: 78.6%

2021: 78.0%

2020: 67.7%

Operating margin shows even more dramatic improvement:

2024: 10.8%

2023: 5.4%

2022: -8.5%

2021: -26.7%

2020: -107.4%

This margin expansion demonstrates improving operational efficiency and increasing returns to scale.

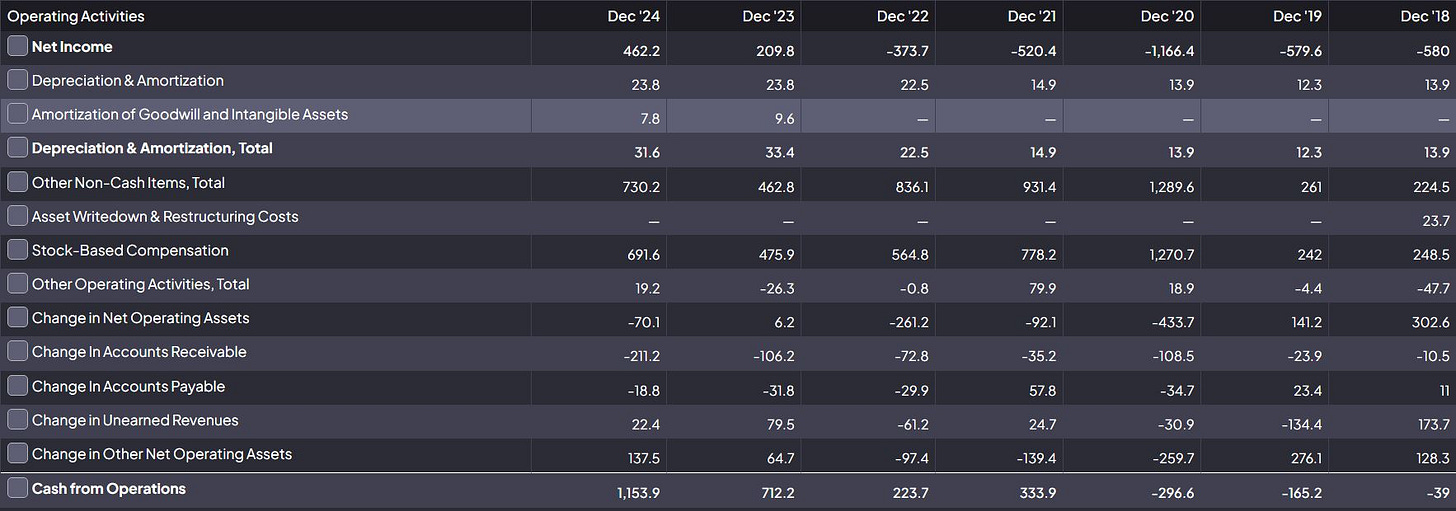

Cash Flow Generation

Cash flow from operations has substantially improved:

2024: $1,153.9M

2023: $712.2M

2022: $223.7M

2021: $333.9M

2020: -$296.6M

This strong cash generation provides financial flexibility for investments and potential shareholder returns.

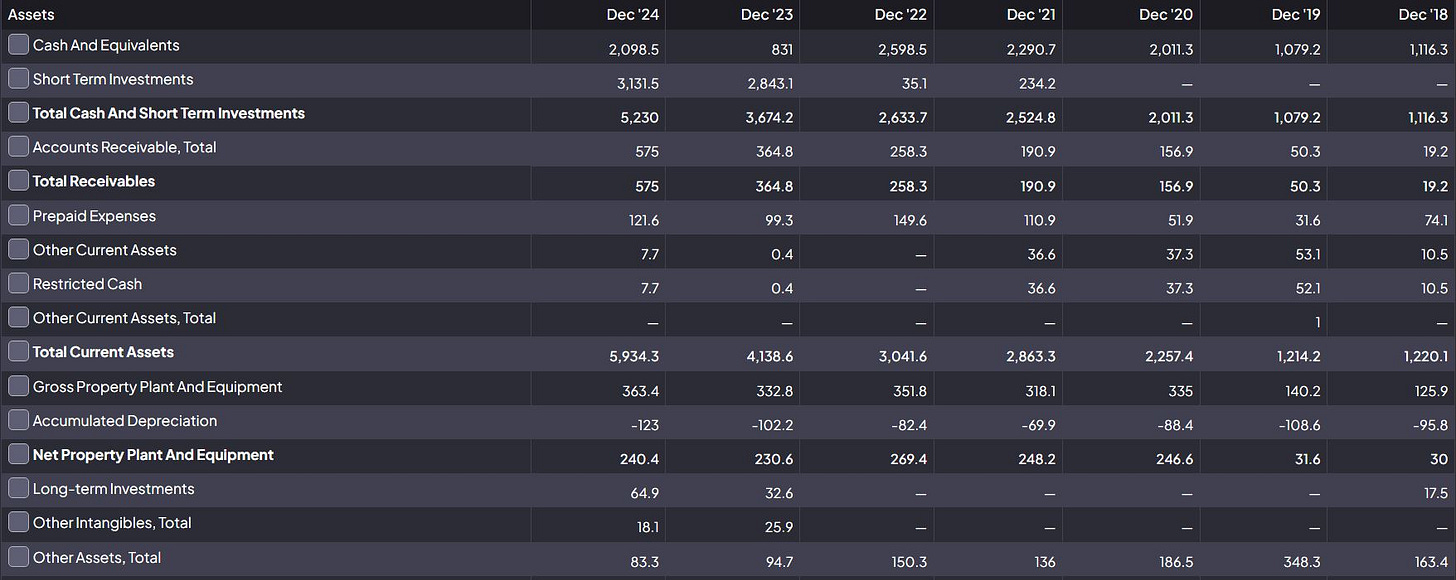

Balance Sheet Strength

Palantir's balance sheet shows significant financial strength:

Cash and short-term investments: $5,230.0M (Dec 2024), up from $3,674.2M (Dec 2023)

Total current assets: $5,934.3M (Dec 2024)

No reported long-term debt

Growing accounts receivable ($575.0M in 2024 vs $364.8M in 2023), reflecting larger contracts

Investment in R&D

Palantir continues to invest heavily in R&D:

2024: $507.9M (17.7% of revenue)

2023: $404.6M (18.2% of revenue)

2022: $359.7M (18.9% of revenue)

This sustained R&D investment supports long-term competitive advantages and product innovation.

Stock-Based Compensation

Stock-based compensation remains significant but is declining as a percentage of revenue:

2024: $691.6M (24.1% of revenue)

2023: $475.9M (21.4% of revenue)

2022: $564.8M (29.6% of revenue)

2021: $778.2M (50.5% of revenue)

2020: $1,270.7M (116.3% of revenue)

The downward trend in SBC as a percentage of revenue is encouraging, suggesting a path toward more shareholder-friendly compensation practices.

7. Investment Outlook

Short-Term Catalysts (1-2 Years)

AIP Adoption: Accelerating the adoption of Palantir's AI Platform could drive revenue growth beyond current expectations.

Margin Expansion: Continued operating leverage from the scalable business model should lead to further margin improvements.

Commercial Customer Growth: Expansion of the commercial customer base, particularly among larger enterprises, could reduce customer concentration risk.

Medium-Term Drivers (3-5 Years)

International Growth: Expanded global footprint and penetration of international markets.

Product Ecosystem Expansion: Development of additional software modules and industry-specific solutions.

Reduced Stock-Based Compensation: Continuing decline in SBC as a percentage of revenue, improving economic profitability.

Long-Term Positioning (5+ Years)

Palantir's long-term success depends on:

Maintaining technological leadership in AI and data analytics

Successfully integrating emerging technologies into its platforms

Expanding beyond its core government business into broader commercial applications

Developing a more efficient go-to-market strategy for mid-market customers

8. Conclusion and Recommendation

Recommendation: BUY

Palantir Technologies represents a compelling investment opportunity for growth-oriented investors with a medium to long-term horizon. The company's financial transformation is remarkable, transitioning from substantial losses to strong profitability while maintaining impressive revenue growth.

Key investment considerations:

Financial Inflection Point: Palantir has reached an inflection point with sustainable profitability and strong cash flow generation.

AI Leadership: The company's early mover advantage in enterprise AI applications positions it well in a rapidly growing market.

Margin Expansion: Continued operating leverage should drive further margin improvements.

Balance Sheet Strength: Significant cash reserves provide flexibility for strategic investments.

Valuation Perspective: While Palantir trades at a premium to traditional software companies, the combination of strong revenue growth, improving profitability, and strategic positioning in AI justifies a premium valuation. Investors should consider dollar-cost averaging to mitigate potential volatility.

Risks to Monitor: Key risks include customer concentration, competitive pressures in the AI space, high stock-based compensation, and potential government contract volatility.

Palantir represents an opportunity to invest in a differentiated data analytics and AI platform with deep technological advantages, strong government relationships, and expanding commercial opportunities. The company's financial transformation demonstrated in the provided data, indicates a maturing business model that is generating substantial value.