Executive Summary

Robinhood Markets, Inc. operates a disruptive financial services platform aimed at democratizing finance for all. The company offers commission-free trading of stocks, ETFs, options, and cryptocurrencies, alongside educational resources. Headquartered in Menlo Park, California, Robinhood targets millennials and Gen Z, driving user engagement through its intuitive platform and mobile-first approach.

Financial Performance Analysis

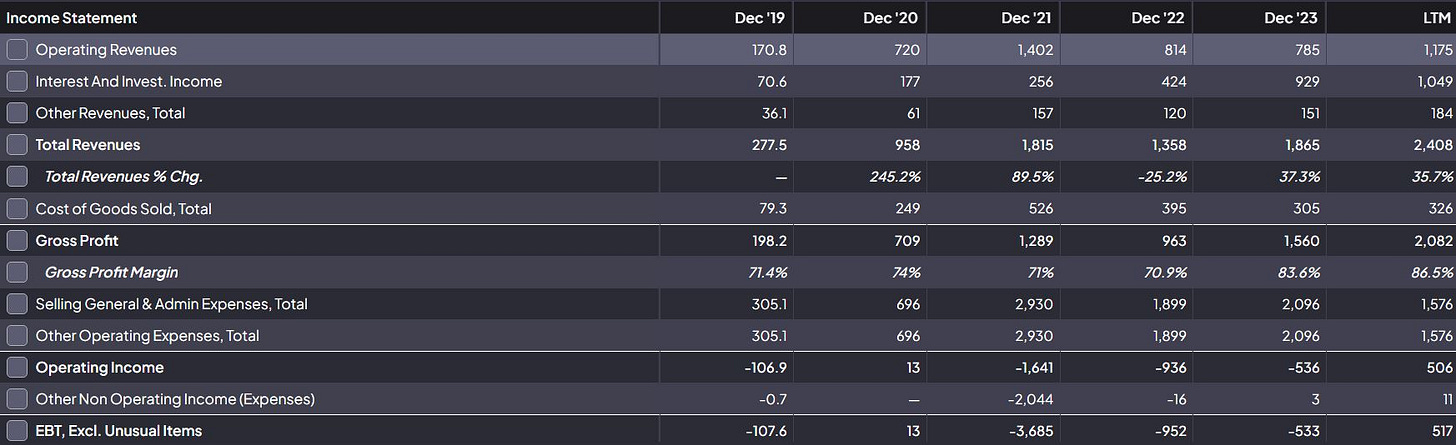

Income Statement

Revenue Growth:

Robinhood's total revenues showed strong volatility, growing significantly in certain periods (e.g., 89.5% YoY in 2021) but contracting in others (-25.2% in 2022). For the last twelve months (LTM), revenues rebounded with 35.7% growth, reaching $2.4 billion.

The contribution from interest income rose significantly in 2023, reaching $929 million compared to $424 million in 2022.

Profitability:

Gross margins remained robust, improving to 86.5% in the LTM from 70.9% in 2022.

Despite improvements in revenues and margins, operating income and net income remain in the red, though losses have narrowed to $533 million (LTM) compared to $952 million in 2022.

Operating Expenses:

Selling, general, and administrative expenses saw a sharp decline in 2023, signaling improved cost discipline.

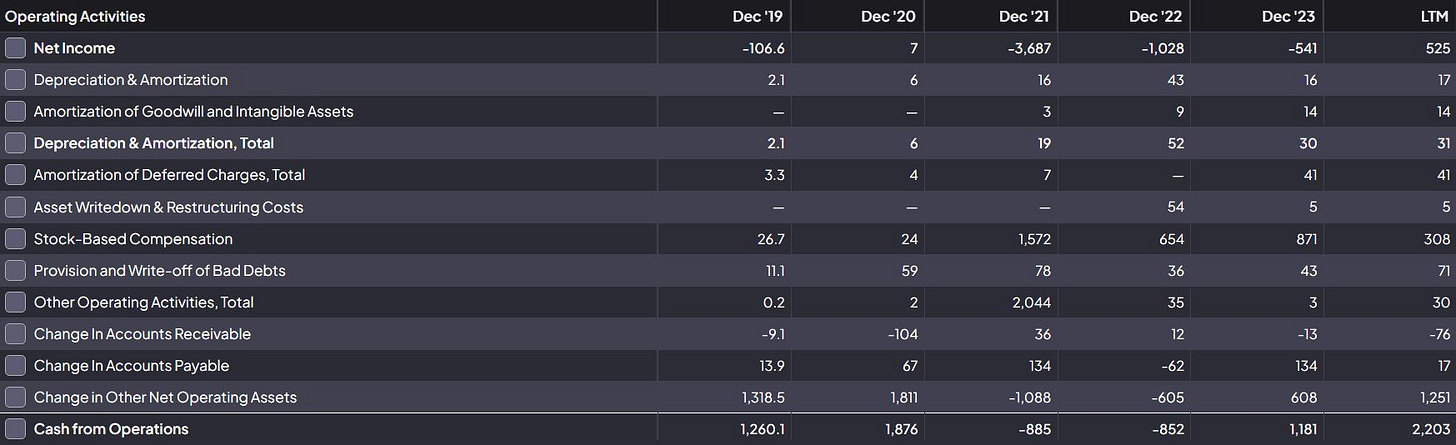

Cash Flow Statement

Cash from Operations:

Cash flow from operations turned positive in 2023 ($1.18 billion), marking a significant improvement from negative cash flows in prior years.

This suggests enhanced operational efficiency and stronger cash conversion from the business model.

Investments and Financing:

Robinhood maintains high capital reserves, with substantial inflows from financing activities in prior periods.

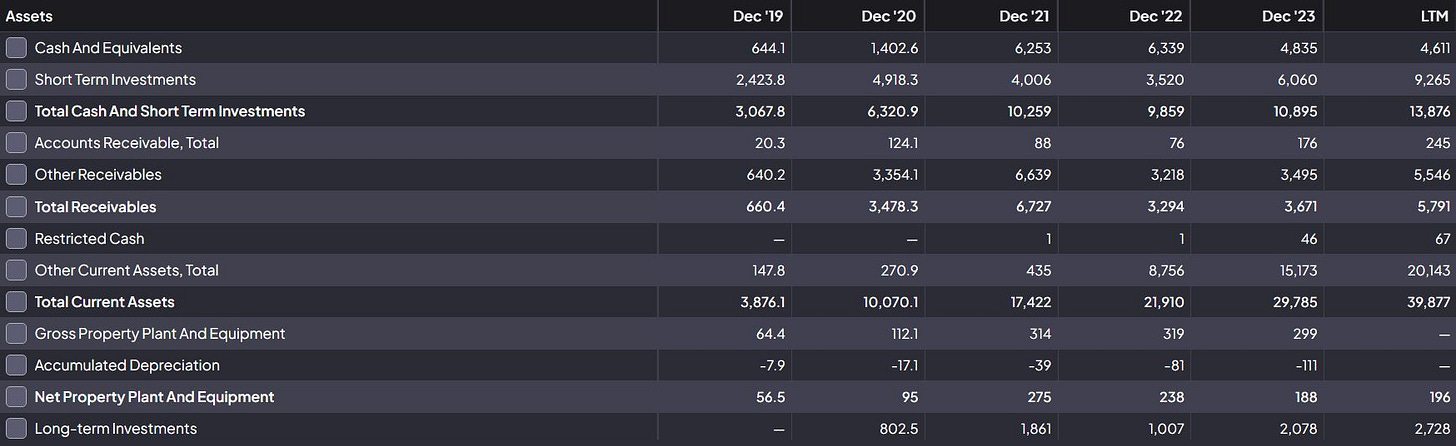

Balance Sheet

Liquidity Position:

Total cash and short-term investments reached $13.9 billion (LTM), ensuring ample liquidity to fund operations and weather economic downturns.

The company also maintains healthy current assets, which grew to $20.1 billion (LTM).

Asset Composition:

Receivables increased to $5.8 billion (LTM), reflecting higher activity levels.

Net property, plant, and equipment remain minimal, highlighting its asset-light business model.

Competitive Positioning

Robinhood benefits from several competitive advantages:

User Experience: Its mobile-first, commission-free trading platform offers a seamless experience, particularly appealing to young investors.

Market Leadership in Retail Investing: Robinhood has positioned itself as a household name in retail trading, especially in crypto and options trading.

Educational Tools: The company fosters customer loyalty through educational content and financial literacy tools, creating stickier users.

However, the company faces intense competition from incumbent brokerage firms (e.g., Charles Schwab, Fidelity) and newer entrants offering similar commission-free trading models.

Risks

Regulatory Challenges: The highly regulated nature of financial services exposes Robinhood to potential fines or changes in operational requirements.

Revenue Concentration: A significant portion of revenue comes from interest income and payment for order flow (PFOF), both sensitive to market conditions and regulatory scrutiny.

Customer Retention: The platform's reliance on younger, less-experienced investors makes it vulnerable to declining engagement during market downturns.

Profitability Concerns: Despite improving cash flows, Robinhood has yet to achieve consistent profitability, which could weigh on investor sentiment.

Investment Outlook

Bull Case:

Robinhood leverages its growing user base, robust product expansion, and improving operational efficiency to achieve profitability. A favorable macro environment (e.g., rising interest rates) boosts net interest income while increasing trading volumes and diversified revenue streams drive sustainable growth. Successful navigation of regulatory challenges and enhanced customer engagement solidify its position as a dominant fintech player, unlocking significant long-term valuation upside.

Bear Case:

Regulatory changes (e.g., restrictions on PFOF) and macro headwinds (e.g., prolonged market downturns) could erode key revenue streams. Failure to retain users, grow engagement, or control costs may prevent profitability. Elevated competition and reputational risks further threaten Robinhood’s market position, potentially leading to valuation declines and investor skepticism.

Robinhood's future hinges on its ability to innovate, execute, and adapt to changing market and regulatory conditions.

Conclusion and Recommendation

Robinhood Markets, Inc. presents a high-risk, high-reward opportunity. Investors bullish on the growth of retail investing and fintech disruption may find value in Robinhood's platform, especially as it expands its product offerings and monetization efforts. However, cautious investors should monitor its profitability path and regulatory risks before committing to a long-term position.

Recommendation: Hold with an eye toward long-term profitability improvements.