1. Investment Summary

Recommendation: BUY

Rolls-Royce Holdings PLC represents one of the most compelling stories of recovery in the aerospace market today. The company has demonstrated remarkable resilience and strategic execution, transforming from pandemic-induced losses to robust profitability. With a 2024 underlying operating profit of £2.5bn and strong free cash flow generation of £3.782bn, Rolls-Royce has successfully navigated the aviation downturn and positioned itself for sustained growth. The company's reinstated dividend policy and announced £1bn share buyback program underscore management's confidence in the business trajectory. Trading at attractive valuations despite significant operational improvements, Rolls-Royce offers compelling risk-adjusted returns for investors seeking exposure to the aerospace recovery and long-term aviation growth trends.

2. Company Overview

Rolls-Royce Holdings PLC is a British multinational aerospace and defense company founded in 1884 and headquartered in London. The company operates through four primary business segments:

Civil Aerospace (60% of revenue): Develops, manufactures, and services aero engines for large commercial aircraft, regional jets, and business aviation markets. Key products include the Trent engine family powering Boeing 787s and Airbus A350s.

Power Systems (25% of revenue): Provides integrated solutions for marine, defense, power generation, and industrial markets, including ship propulsion systems and backup power generation.

Defence (10% of revenue): Supplies aero engines for military transport and patrol aircraft, naval engines, and submarine nuclear power plants, along with comprehensive aftermarket services.

New Markets (5% of revenue): Focuses on emerging technologies including small modular reactors (SMRs) and electrical power solutions for sustainable aviation and power generation.

Rolls-Royce is one of only three companies globally capable of manufacturing large commercial aircraft engines, competing directly with General Electric and Pratt & Whitney. The company's business model emphasizes long-term aftermarket services, generating recurring revenue streams from maintenance, repair, and overhaul services throughout the engines' operational life.

3. Competitive Positioning

Strengths:

Oligopolistic Market Position: One of only three global manufacturers of large commercial aircraft engines, creating significant barriers to entry

Advanced Technology Leadership: Cutting-edge engine technology with industry-leading fuel efficiency and performance characteristics

Aftermarket Dominance: Strong recurring revenue from maintenance and services, typically generating 60-70% of segment profits

Long-term Contracts: Established relationships with major airlines and OEMs provide visibility and stability

Defense Heritage: Strong position in naval propulsion and nuclear submarine technology

Competitive Advantages:

Intellectual Property: Extensive patent portfolio and proprietary technologies developed over 140 years

Scale and Scope: Global manufacturing and service network with presence in over 150 countries

Customer Relationships: Deep, long-term partnerships with airlines, defense contractors, and industrial customers

Regulatory Expertise: Advanced capabilities in highly regulated aerospace and nuclear sectors

Financial Resilience: Proven ability to navigate industry cycles and emerge stronger

4. Opportunities

Near-term Catalysts:

Aviation Recovery: Continued recovery in global air travel driving higher engine flying hours and aftermarket demand

Pent-up Demand: Deferred maintenance and engine overhauls create significant near-term service opportunities

Wide-body Recovery: Gradual return of long-haul international travel benefiting Rolls-Royce's wide-body engine portfolio

Cost Optimization: Ongoing operational efficiency improvements and cost reduction initiatives

Long-term Growth Drivers:

Fleet Modernization: Airlines replacing older, less efficient aircraft with new-generation planes powered by Rolls-Royce engines

Emerging Markets: Growing aviation demand in Asia-Pacific, the Middle East, and Africa

Sustainable Aviation: Leadership in sustainable aviation fuels and next-generation propulsion technologies

Small Modular Reactors: Potential breakthrough in nuclear power generation addressing the clean energy transition

Defense Modernization: Increasing global defense spending is driving demand for advanced propulsion systems

5. Risks

Operational Risks:

Cyclical Industry: Aviation industry is susceptible to economic downturns, geopolitical events, and external shocks

Technical Challenges: Complex engineering projects are subject to cost overruns and delays

Regulatory Changes: Environmental regulations could impact engine designs and operational requirements

Supply Chain Dependencies: Reliance on specialized suppliers for critical components

Pandemic Impact: Future health crises could severely impact aviation demand

Financial Risks:

Customer Concentration: Dependence on major airline customers and aircraft manufacturers

Foreign Exchange Exposure: Significant exposure to USD/GBP exchange rate fluctuations

Capital Intensity: High R&D and capital investment requirements for new engine development

Pension Obligations: Substantial pension liabilities requiring ongoing funding

Market Risks:

Competition: Intense competition from GE and Pratt & Whitney in core markets

Technology Disruption: Potential disruption from electric or hydrogen-powered aviation

Geopolitical Tensions: Trade restrictions or sanctions affecting international operations

Environmental Concerns: Growing pressure for sustainable aviation solutions

6. Financial Analysis

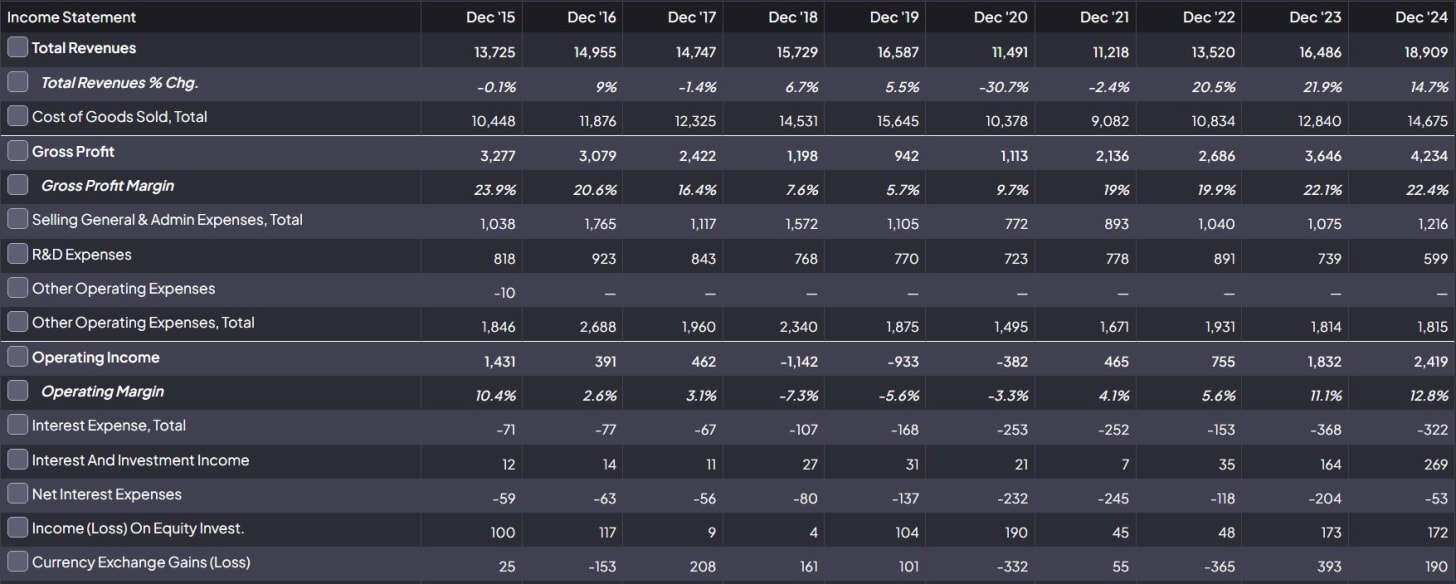

Revenue Recovery and Growth:

The financial data reveals a remarkable recovery trajectory. Total revenues declined from £13.7bn in Dec'15 to a low of £11.2bn in Dec'21 during the pandemic, but have since recovered strongly to £18.9bn in Dec'24, representing a 14.7% year-over-year growth. This 68% increase from the pandemic trough demonstrates the company's operational resilience and the strength of the aviation recovery.

Profitability Transformation:

Operating Margin Recovery: Operating margins improved dramatically from -5.6% in Dec'19 to 12.8% in Dec'24, indicating successful cost management and operational efficiency

Net Income Turnaround: Net income recovered from significant losses of -£4.0bn in Dec'16 and -£3.2bn in Dec'20 to strong profitability of £2.5bn in Dec'24

Gross Profit Stability: Gross profit margins stabilized around 22-23%, indicating pricing power and operational efficiency

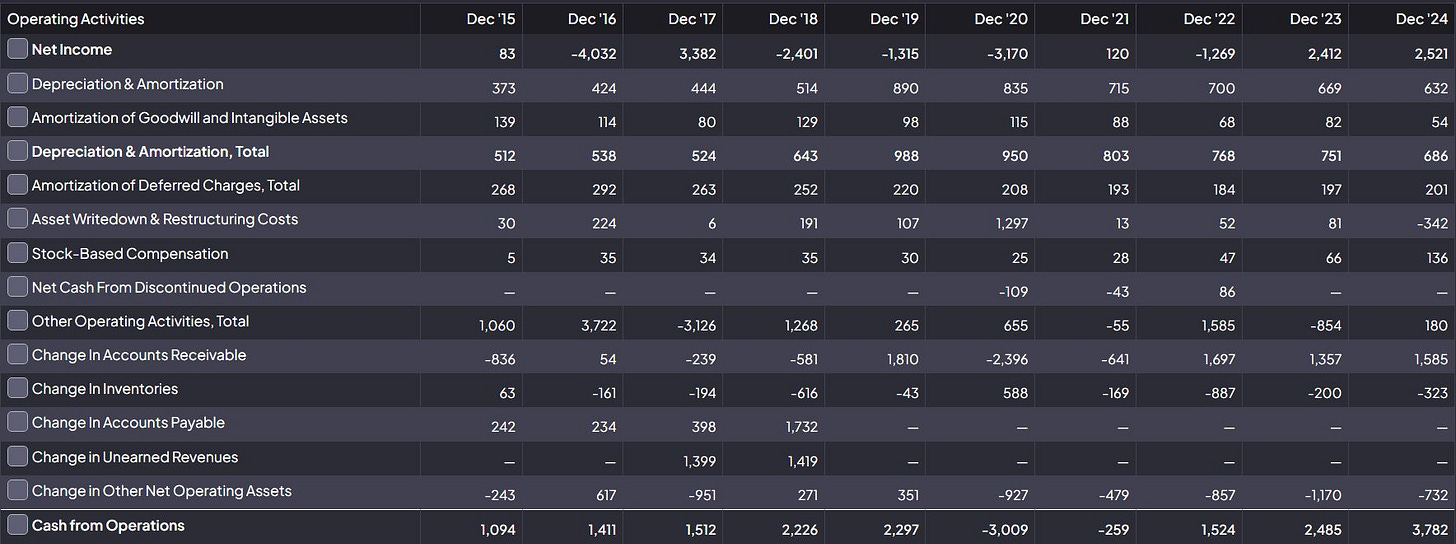

Cash Flow Excellence:

Operating Cash Flow: Dramatic improvement from negative £3.0bn in Dec'20 to positive £3.8bn in Dec'24, demonstrating strong cash generation capabilities

Free Cash Flow: Strong free cash flow generation supporting dividend reinstatement and share buyback programs

Working Capital Management: Effective management of receivables and inventory supporting cash flow optimization

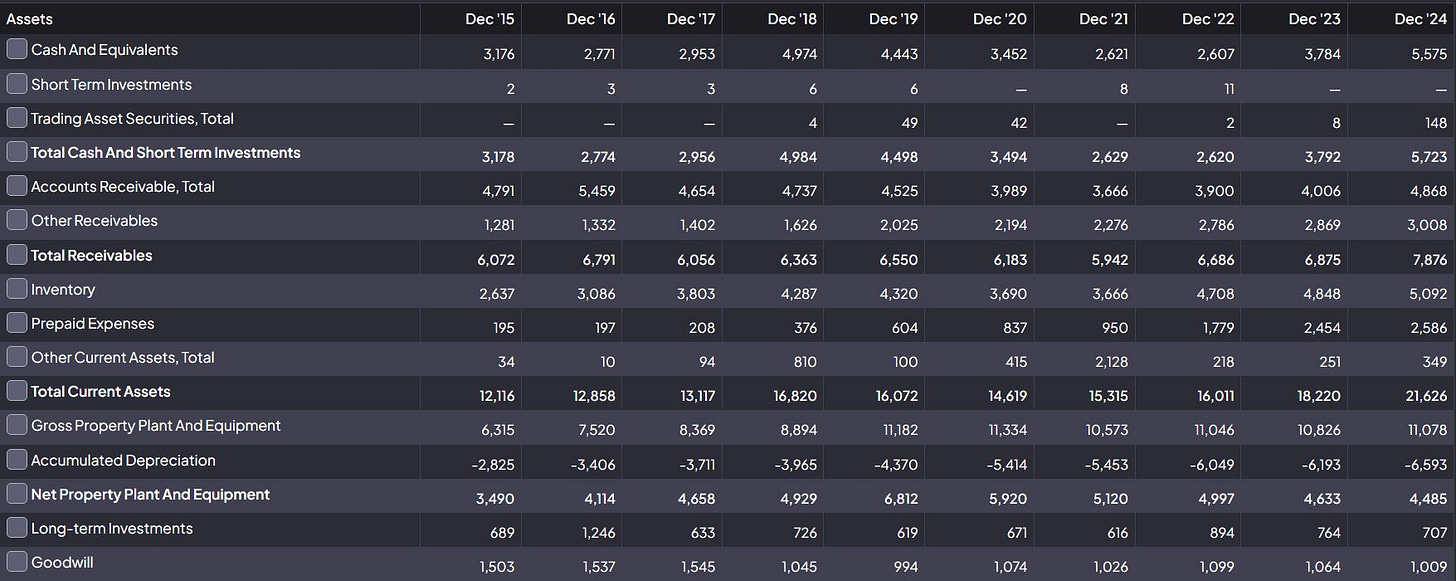

Balance Sheet Strength:

Cash Position: Substantial cash reserves of £5.6bn providing financial flexibility and resilience

Asset Base: Net PPE of £4.5bn supporting operational capabilities and long-term growth

Debt Management: Improved debt profile and reduced financial leverage

Key Financial Metrics:

Revenue Growth (Dec'24): +14.7% year-over-year

Operating Margin: 12.8% (industry-leading performance)

Return on Assets: Significant improvement in asset utilization

Cash Conversion: Strong operational cash generation exceeding reported profits

The financial trajectory demonstrates exceptional management execution, with the company successfully navigating the pandemic crisis and emerging as a more efficient, profitable organization. The combination of revenue recovery, margin expansion, and cash generation provides a solid foundation for sustained growth and shareholder returns.

7. Investment Outlook

Positive Factors:

Aviation Recovery: Global air travel is continuing to recover, with wide-body international routes showing strong momentum

Aftermarket Momentum: Engine flying hours approaching pre-pandemic levels, driving higher-margin aftermarket revenue

Operational Leverage: Fixed cost base providing significant operating leverage as activity levels increase

Capital Allocation: Management demonstrating commitment to shareholder returns through dividends and buybacks

Technology Leadership: Continued investment in next-generation engine technologies and sustainable aviation

Valuation Considerations:

Recovery Premium: Stock may still trade at a discount to historical multiples despite operational improvements

Earnings Quality: High-quality earnings supported by recurring aftermarket revenues

Free Cash Flow Yield: Attractive free cash flow generation supporting dividend sustainability

Peer Comparison: Favorable valuation relative to aerospace and defense peers

Timeline Expectations:

Short-term (1-2 years): Continued recovery in civil aerospace driving revenue and margin expansion

Medium-term (3-5 years): Fleet modernization and emerging market growth supporting sustained growth

Long-term (5+ years): Technology leadership and market position driving premium valuations

8. Conclusion and Recommendation

Investment Recommendation: BUY

Rolls-Royce Holdings PLC presents an exceptional investment opportunity, representing one of the most successful corporate turnarounds in recent history. The company has transformed from pandemic-induced distress to industry-leading profitability, demonstrating exceptional management execution and operational resilience.

Key Investment Merits:

Operational Excellence: Achievement of 12.8% operating margins and £3.8bn cash generation demonstrates world-class operational performance

Market Leadership: Oligopolistic position in large commercial engines with significant barriers to entry

Recovery Leverage: Continued aviation recovery providing substantial operating leverage and earnings growth

Shareholder-Friendly: Dividend reinstatement and £1bn share buyback program demonstrating commitment to returns

Technology Moat: Advanced engineering capabilities and intellectual property providing sustainable competitive advantages

Target Investor Profile:

Growth investors seeking exposure to aerospace recovery and long-term aviation growth

Value investors are attracted to the successful turnaround story and attractive valuations

Income investors are benefiting from the reinstated dividend policy and strong cash generation

ESG-focused investors supporting sustainable aviation and clean energy initiatives

Financial Targets:

Based on the company's upgraded mid-term guidance, Rolls-Royce is targeting an underlying operating profit of £3.6bn-£3.9bn and free cash flow of £4.2bn-£4.5bn, representing significant upside from current levels. The combination of operational improvements, market recovery, and strategic positioning makes Rolls-Royce an attractive addition to diversified portfolios, particularly for investors seeking exposure to the aerospace sector during a period of sustained recovery and growth.

The company's transformation from crisis to industry leadership, combined with strong financial metrics and favorable market dynamics, supports a strong BUY recommendation with attractive risk-adjusted return potential.