Snowflake Inc. $SNOW operates as a leading cloud-based data platform provider, facilitating data storage, processing, and sharing for businesses worldwide. Below is an analysis based on the provided financial statements and ratios.

Revenue Growth and Profitability

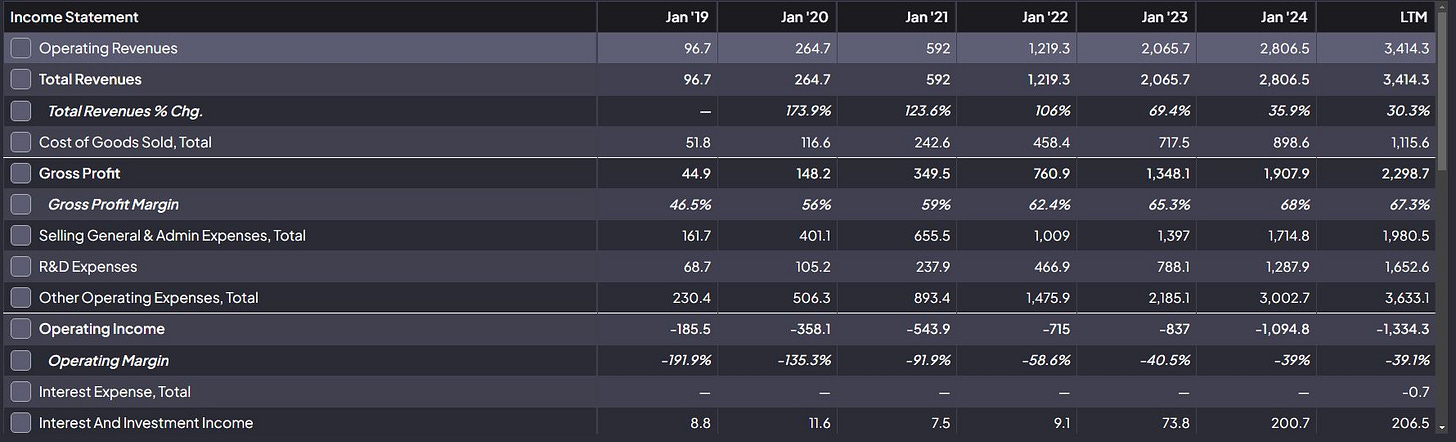

Revenue Trends:

Snowflake has shown impressive revenue growth, with a 5-year CAGR of 96.15% and a 3-year CAGR of 49.3%.

Total revenues increased from $96.7M in FY19 to $3.4B in the latest trailing twelve months (LTM), demonstrating strong adoption of its platform.

Gross Profit:

Gross profit has expanded consistently, rising from $44.9M in FY19 to $2.3B in the LTM.

Gross margins improved from 46.5% in FY19 to 67.3% in the LTM, reflecting economies of scale and operational efficiency.

Operating Income:

Despite robust revenue growth, operating losses persist, with an LTM operating margin of -39.1%.

Snowflake invests heavily in R&D ($1.98B in the LTM, up from $68.7M in FY19) and Sales & Marketing ($1.65B in LTM), suggesting a growth-over-profitability focus.

Net Income:

Negative P/E ratio of -50.87 highlights continued net losses, emphasizing the company's reinvestment strategy for expansion over short-term profitability.

Financial Position

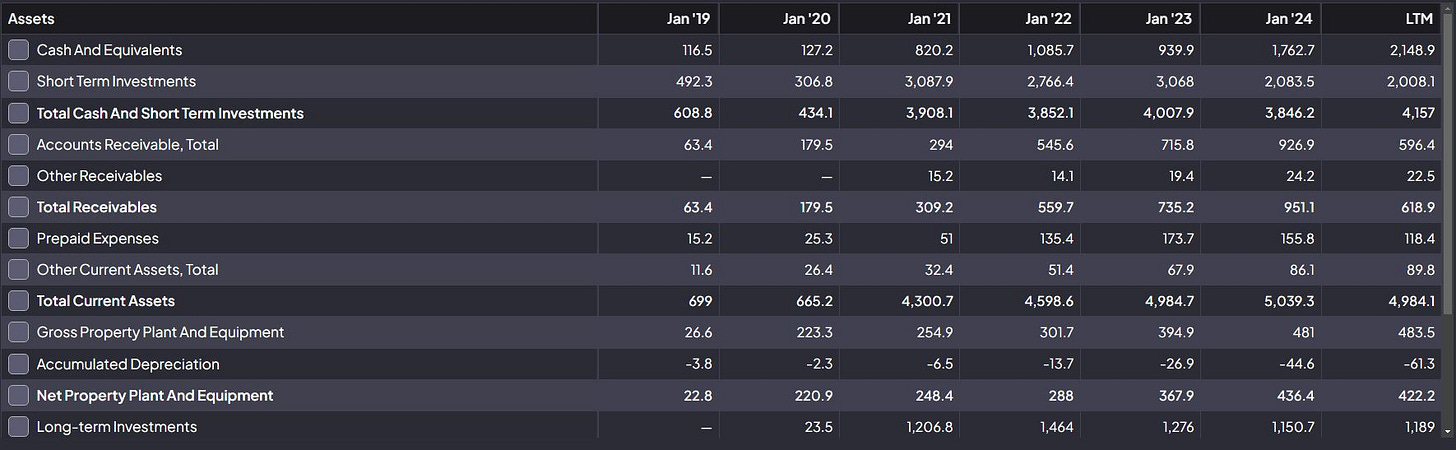

Cash and Investments:

Snowflake maintains a solid liquidity position with $4.16B in cash and short-term investments (LTM), sufficient to fund its operations and growth plans.

Receivables:

Accounts receivable grew significantly to $596.4M (LTM), indicating higher customer billings but warranting monitoring for potential collection risks.

Property, Plant & Equipment (PP&E):

Net PP&E increased steadily, reaching $422.2M, reflecting investments in infrastructure and technology.

Valuation Metrics

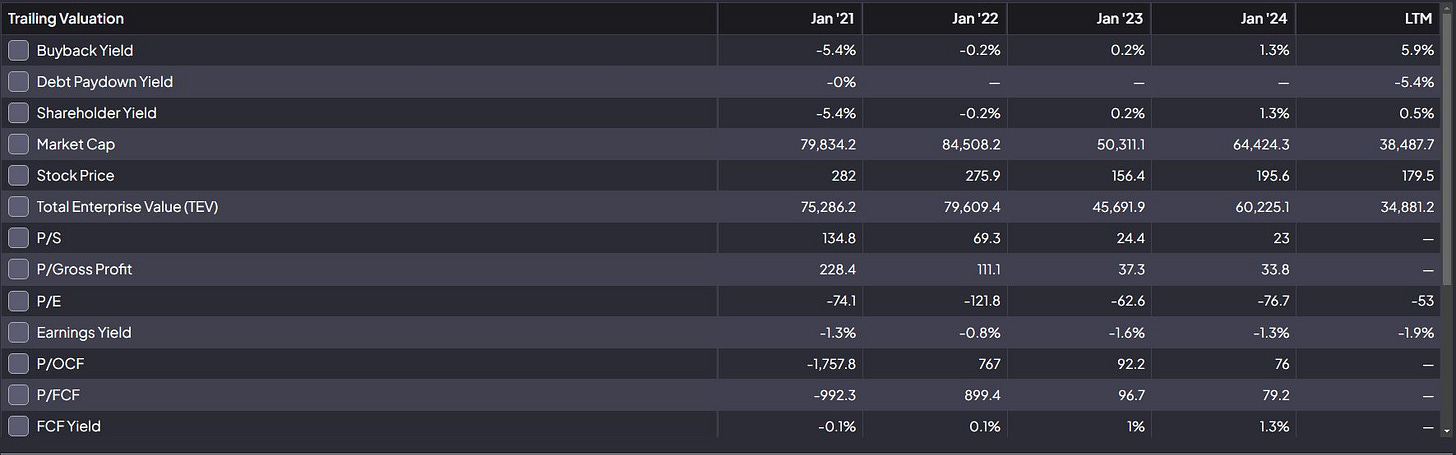

Market Cap:

At a market cap of $56.92B, Snowflake is valued at a premium, driven by its growth potential.

Valuation Ratios:

P/S (Price-to-Sales) ratio at 23 (LTM) indicates a high valuation relative to revenue.

P/OCF (Price-to-Operating Cash Flow) is negative, reflecting cash flow challenges during expansion.

Strengths

Rapid Revenue Growth: Snowflake's exceptional growth rates position it as a leader in the data platform industry.

High Gross Margins: Strong margins provide a solid foundation for future profitability.

Cash Reserves: Ample liquidity ensures stability and room for strategic investments.

Risks

High Valuation: Elevated P/S and negative P/E ratios could pose risks if growth slows or if market sentiment shifts.

Operating Losses: Persistent net losses highlight the challenge of achieving profitability amidst aggressive reinvestments.

Competitive Industry: Snowflake faces competition from cloud giants like AWS, Microsoft Azure, and Google Cloud.

Snowflake's robust revenue growth, innovative product offerings, and strong cash position underline its potential to disrupt the cloud data space. However, its premium valuation and lack of profitability make it suitable primarily for investors with a high-risk appetite seeking exposure to high-growth tech stocks. As the company scales, reducing operating losses and achieving sustainable margins will be critical for long-term value creation.