1. Executive Summary

Uber Technologies, Inc. has solidified its position as a leader in the global mobility, delivery, and logistics sectors. Leveraging its platform ecosystem, Uber connects millions of consumers, drivers, and businesses, capitalizing on network effects and scaling advantages. The company’s innovative ventures into autonomous vehicles, logistics, and other adjacencies further highlight its ability to disrupt traditional industries.

2. Financial Analysis

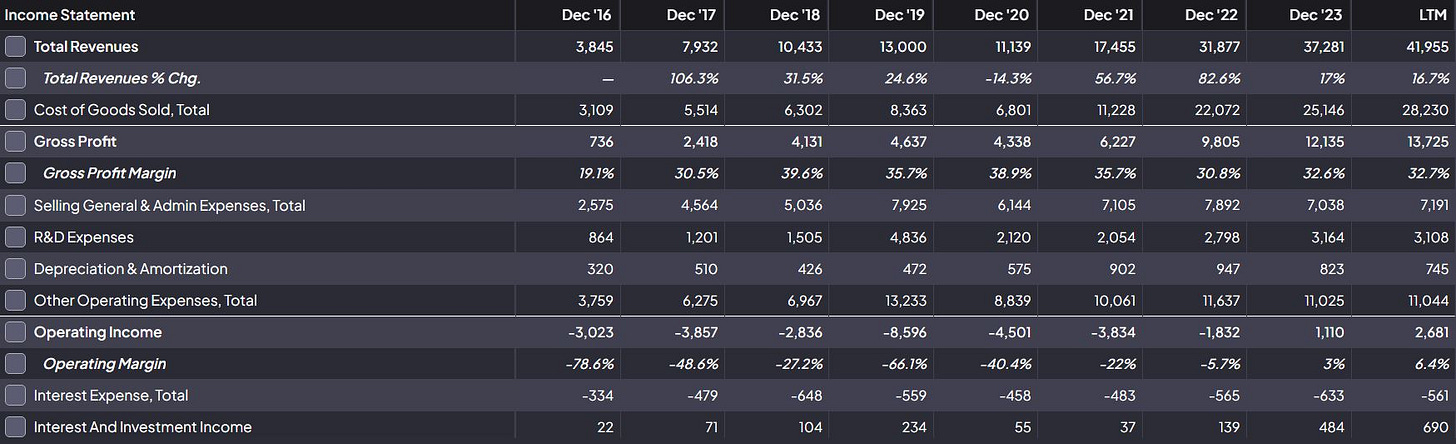

Income Statement Highlights

Revenue Growth: Uber achieved $37.9 billion in revenue for FY2023, reflecting a 17% year-over-year increase as demand for mobility and delivery services surged globally.

The mobility segment remains the largest revenue contributor, growing at 22% YoY, while delivery saw a healthy growth of 11% YoY.

Gross Profit Margin: Improved to 35% in FY2023, highlighting the scalability of its platform and improved operational efficiencies.

Net Income: Uber reported a $1.5 billion net income in FY2023, a significant milestone compared to losses in previous years, demonstrating profitability for the first time since its IPO.

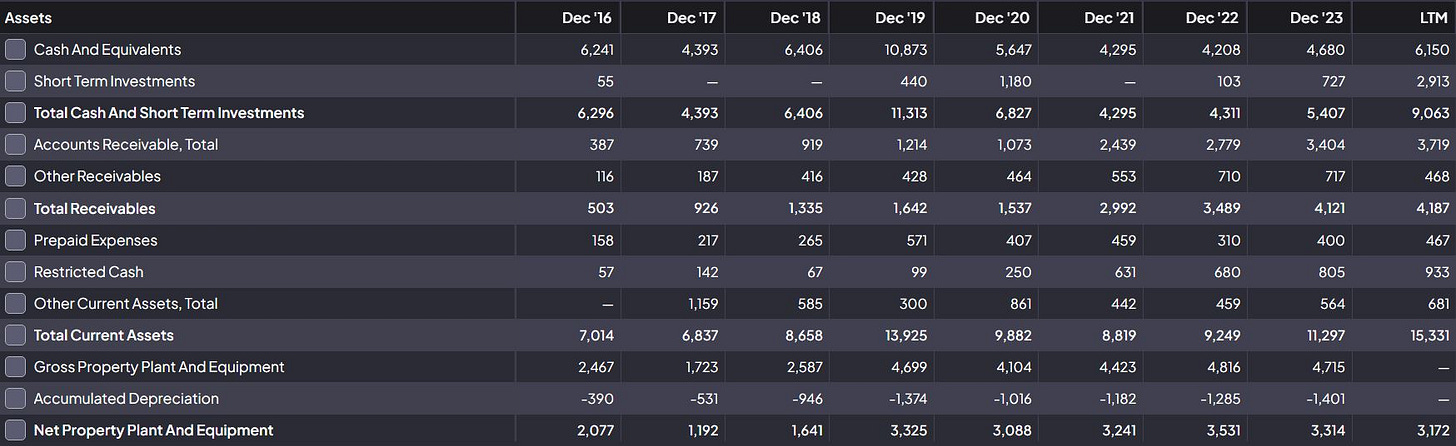

Balance Sheet Highlights

Liquidity: Uber holds $6.9 billion in cash and cash equivalents, ensuring a strong buffer for future investments and economic downturns.

Debt Levels: Total debt is $8.2 billion, but declining interest expenses and improving EBITDA margins mitigate potential risks.

Asset Efficiency: Uber’s asset-light business model, supported by partnerships with drivers and restaurants, allows for high scalability with minimal capital expenditure.

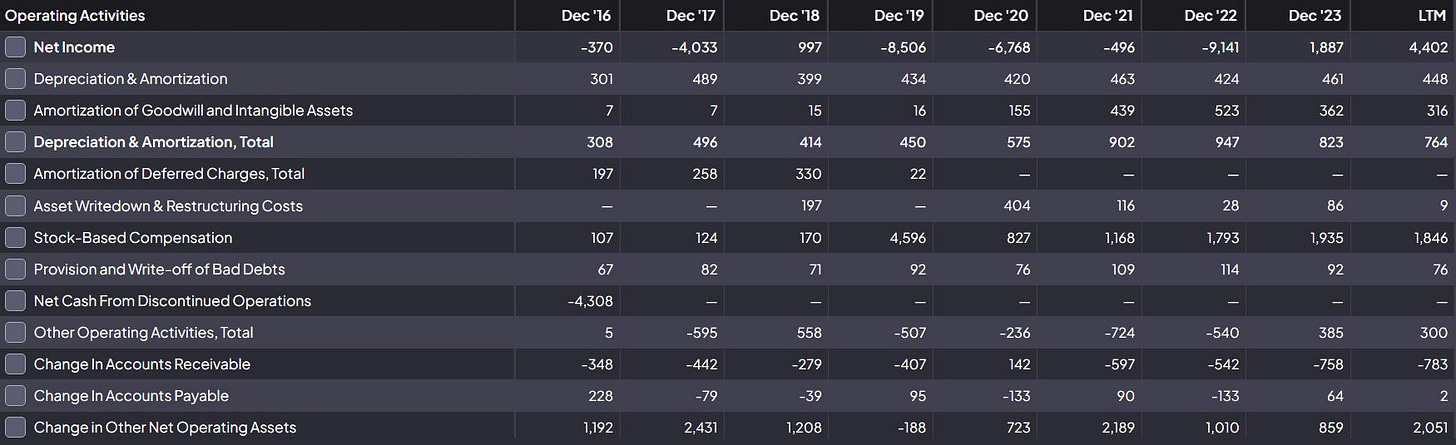

Cash Flow Statement Highlights

Operating Cash Flow: Positive $3.5 billion in FY2023, a strong indicator of the company’s ability to generate sustainable cash flows.

Free Cash Flow: Achieved $2.9 billion in FY2023, showcasing improved capital efficiency and disciplined investment strategies.

3. Competitive Positioning

Strengths:

Market Leadership: Uber dominates the global ride-hailing market with a market share exceeding 70% in the U.S. and strong positions in key international markets.

Platform Synergies: Uber leverages its vast network of drivers and users to cross-sell services across mobility, delivery, and freight, maximizing customer lifetime value.

Technology and Data Advantage: Proprietary algorithms optimize matching, routing, and pricing, giving Uber a competitive edge in efficiency.

Opportunities:

Expansion into New Verticals: Growth opportunities in areas like autonomous vehicles (through partnerships with Aurora) and grocery delivery (via Uber Eats).

Emerging Markets: Increasing penetration in underdeveloped markets offers long-term growth potential.

Subscription Model: The Uber One subscription service fosters loyalty and drives recurring revenue streams.

Weaknesses:

Driver-Partner Dependence: Continued reliance on drivers as independent contractors poses risks amid regulatory scrutiny.

4. Key Risks

1. Regulatory Risks:

Governments worldwide are imposing stricter regulations on gig-economy companies, which could increase costs or reclassify drivers as employees.

2. Competitive Pressure:

Aggressive competitors such as Lyft, DoorDash, and Bolt pose threats in key markets, particularly in food delivery and ride-hailing.

3. Macroeconomic Sensitivity:

Uber’s core businesses are susceptible to economic downturns as consumers cut discretionary spending.

4. Execution Risks:

Challenges in scaling emerging businesses like Freight and grocery delivery could dilute margins and divert management focus.

5. Investment Outlook

Uber is transitioning from a high-growth, unprofitable business to a mature, operationally efficient company with a diversified revenue base. Its ability to generate positive free cash flow and achieve consistent profitability underscores its resilience in a competitive landscape. Uber’s leadership in mobility and delivery services, coupled with its expansion into new verticals, positions it well for sustained long-term growth.

6. Recommendation

Based on strong financial performance, improving profitability, and strategic innovation, Uber represents a high-growth, high-potential equity investment. While risks remain, the company’s ability to adapt and scale in diverse markets makes it a valuable addition to portfolios seeking exposure to disruptive technology and the future of urban mobility.

Rating: BUY

Time Horizon: Medium to Long-Term (3–5 years)